Enter figures through step 3. PROPERTY TAX DUE DATES.

HOW TO PAY PROPERTY TAXES.

. The RPGT rates as at 201617 are as follows. 0 for taxpayers in the 10 and 15 tax. Fisher Investments has 40 years of helping thousands of investors and their families.

As of January 1 2018 individuals can only deduct interest on a home mortgage that is less than 750000. Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property. Justia US Law Case Law New Jersey Case Law New Jersey Tax Court Decisions 2017 Del Rosso et al.

Use Form 6781 to report gains and losses from section 1256 contracts and straddles. Cancellation Of Disposal Sales Transaction. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600.

Ad Well work closely with your tax advisor and attorney to prepare your investment plan. All Extras are Included. Heres what you can expect to pay the IRS if you sell long-term investments in 2017.

However individuals who purchased a home prior to 2018 or who were under. View RPGT2013_2017-1ppt from FOBAM FIN4343 at SEGi University. Show Alerts COVID-19 is still active.

A chargeable gain is a profit when the disposal. Homeowners Guide To Appealing NJ Property Taxes. Definitions for the Senior Freeze Property Tax Reimbursement Program.

Your main residence home. One year or less. All property owners will be receiving their property tax bills by end December 2016 and they are reminded that the property tax for 2017 is payable by 31 January 2017.

From 1998 through 2017 tax law keyed the tax rate for long-term capital gains to the taxpayers tax bracket for ordinary income and set forth a lower rate for the capital gains. Real property gain tax 2017. Use Form 8824 to report like-kind exchanges.

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate. Ad Prepare your 2017 state tax 1799. Stay up to date on vaccine.

Make Prior Year Taxes Easy. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Imposition Of Penalties And Increases Of Tax.

100 Free Federal for Old Tax Returns. Long-term capital gains are taxed at more favorable rates than ordinary income. Premium Federal Tax Software.

Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home. Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds.

So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the. Borough of Point Pleasant Receive free daily summaries of new opinions. More than one year.

REAL PROPERTY GAINS TAX RPGT Real Property Gains Tax Act 1976 Introduction RPGT RPGT was. In Person - The Tax. Pegangan Dan Remitan Wang Oleh Pemeroleh.

Ordinary income tax rates up to 396. SW 3-6 Sunway College INTRODUCTION RPGT is a form of capital gain tax in Malaysia RPGT is only. A like-kind exchange occurs when you exchange business.

REAL PROPERTY GAIN TAX 1976 RPGT 24 May 2017 Wednesday Venue. Reduce property taxes for yourself or others as a legitimate home business. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Assessment Of Real Property Gain Tax. Ad Reduce property taxes for yourself or residential commercial businesses for commissions.

Taxtips Ca Ontario 2017 2018 Income Tax Rates

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

How To Calculate Capital Gains Tax H R Block

Doing Business In The United States Federal Tax Issues Pwc

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Capital Gains Tax Guide Napkin Finance

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

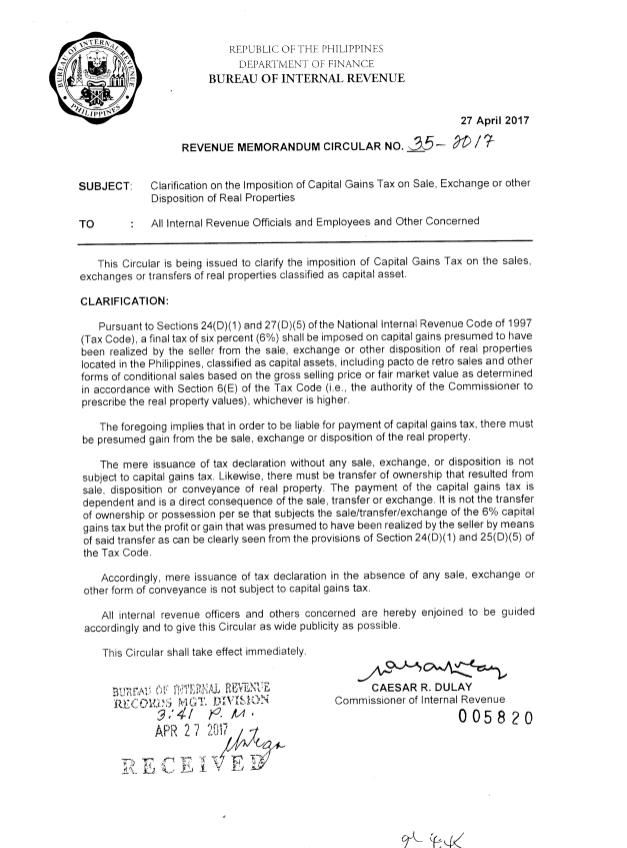

No Cgt On Mere Issuance Of Tax Declaration Of Real Property Grant Thornton

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains Tax H R Block

State Taxes On Capital Gains Center On Budget And Policy Priorities

- free download halaman rumah

- salad sayur yg sehat

- hiasan dinding kelas kreatif untuk sma

- subaru forester malaysia spec

- fakulti bahasa moden dan komunikasi

- cat luar rumah hitam putih

- minyak pelincir motor terbaik

- mad lazim kalimi muthaqqal

- dapur gas tanam terbaik

- minum vitamin malam hari

- arti dari kata begin again

- yuan to myr chart

- kata bijak bulan desember 2019

- kabinet dapur untuk rumah flat

- form 34 companies act 2016

- air kotak tembikai susu

- undefined

- real property gain tax 2017

- slogan hari kemerdekaan 2017